All About Hedging Strategy

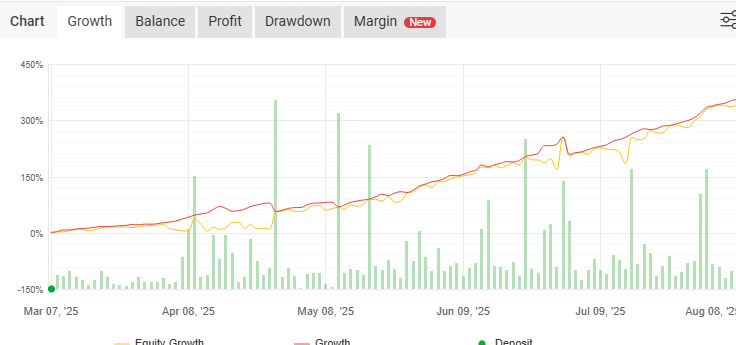

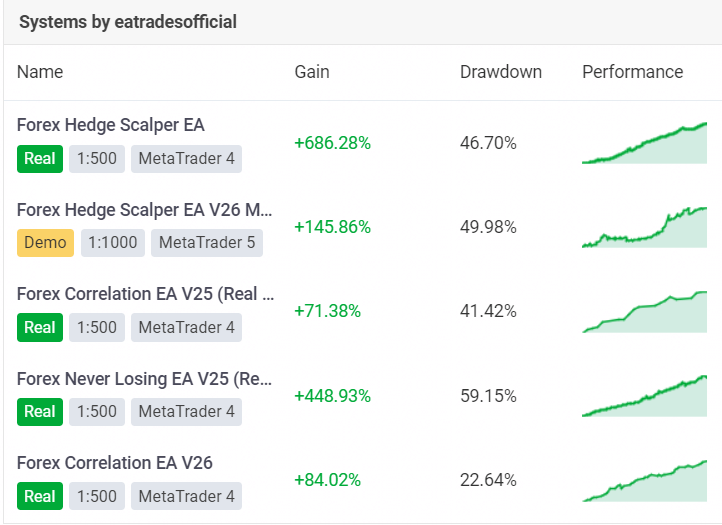

Many questions and confusions about hedging strategy in forex. As we sell forex EAs here and all of our forex EAs has hedging strategy options. We know that most of the people knows about it and have full clear idea whether what actually hedging is! and how it works.

but still this blog post is going to help you to understand how hedging works generally which is important for beginners to know about it and similarly this post will be explaining whether how we use hedging methods in our forex EAs which is going to help beginners and professionals, especially those who are using our forex EAs ie, hedge scalper EA, correlation EA and forex ai trend ea. Lets start with some basic questions and then we will learn whether how it works in our EAs and how you can use it to minimize your risk and maximize your profit in forex trading.

Lets explain it in very simple words that everyone can understand it easily.

Hedging strategies in Hedge Scalper EA

Not only in the hedge scalper EA but we use hedging strategies in all of our forex EAs. The 2 main hedging methods we use in all of our forex EAs. the methods are very similar but not exactly same in each EA. these two methods are listed below.

Hedging In Pair

Using Hedging in pair is simply means hedging between buys and sells in pair and each trading pair is behaving independently with its own orders. Example we have 3 running pairs, EURUSD, GBPUSD and USDJPY. The EURUSD is hedging with its own trades and other pairs hedging with their own trades. But there is no cross relation or hedging using this method of hedging strategy.

Hedging with other Pairs

We also call is external hedging where we use a method to cross check and hedge orders with other trading pairs to make it more profitable safer for trading in forex. Example we have 3 running pairs, EURUSD, GBPUSD and USDJPY. there is possibility that EURUSD is hedging with USDJPY and USDJPY is hedging with GBPUSD while GBPUSD is hedging with itself. This sequence is totally independent and keeps changing time to time depending on the need of hedge.

Does hedging makes your trading profitable?

There can’t be either Yes or No, its because it depends on the need and the situation of the market and account. That’s why we call our forex EAs as Forex Ai EA, Just because according to the need and trading situations these hedging methods switches on and off automatically where user doesn’t need to do anything. And using hedging on right time and right ratio can make your trading profitable otherwise it just ads burden on trading account.

What ratio of hedge i should use?

As we have options in our forex EAs for hedging ratio for both internal and external hedging strategies. the tighter hedge may leads to burden on account and higher drawdowns, while very light hedging also leads to drawdowns. But to over come this issue, we have made a automatic set file system where you just need to explain your choice of risk, and your trading account specifications, the system will create you a ready made set file to use.

The information below is very basic one for beginners only.

What is Forex Hedging Strategy?

Hedging is a trading strategy to balance your trade directions to reduce risk or loss and make some additional profit. it is going to balance between buy and sell trades. Example you may have 4 orders using 0.01 on buy and 7 orders on sell with 0.01 which means that you have 0.04 lots in hedge. this how it reduce the risk of losses from sell orders because as the loss increases from sell 7 orders, similarly your profit from 4 buy orders will increase.

Why Hedging is Important?

As talked about initially that it reduce risk and maximize profit. sometimes the market is highly trended and doesn’t goes to your favorable trades, at that time its better to open hedge orders instead of closing your losing trades. Example, the market is moving down trended while you have open orders in buys, so opening sell orders here means you are hedging your trades and reducing risk of loss if the market keep moving down. So hedging is important when you are facing losses and market is not moving into favor.

When to use hedging strategy?

Simply, use of hedging all the times may not be useful as it reduce the risk, similarly it reduce profits when you are not using in right time. So keep hedging all the times won’t any sense. because hedging is important only when there is risk of more losses as its the process of locking losses temporarily, but not for permanently. So use hedging only when needed.

What does 50% hedge mean?

50% hedge is when you have almost half of the trades in opposite side and 100% hedge is when you have almost equal lots on both buys and sells. But 100% hedge won’t make any difference in profit loss except only your spread loss.